Foreign Trade Zone

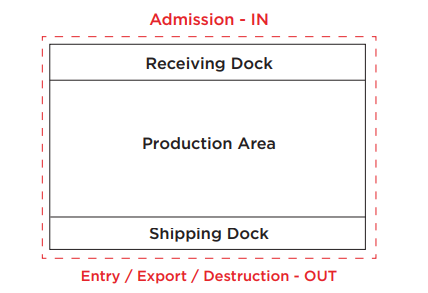

Foreign Trade Zones (FTZs), also referred to as Free Trade Zones, are specific areas within the United States where imported goods are considered to be outside U.S. Customs territory. This means businesses can store, assemble, or manufacture products without immediately paying duties or taxes. Duties are only paid when goods leave the zone and enter U.S. commerce if they’re exported or destroyed, no duties are due. For importers, FTZs offer a strategic way to defer, reduce, or even eliminate duty and tax costs, making them a valuable tool for improving cash flow and reducing operational expenses.

Benefits to Our Customer

- Duty Deferral: Pay Customs duties only when goods leave the FTZ and enter U.S. commerce.

- Duty Elimination: No duties if goods are exported or destroyed in the FTZ.

- Lower Fees: Combine shipments into one weekly Customs entry Merchandise Processing Fee (MPF) capped at $614.35/week, saving thousands annually.

- Faster Processing: Streamlined Customs handling and quicker delivery.

- Inventory Flexibility: Store, sort, or repackage goods without triggering duties.

Pharmaceutical Leveraged FTZ

Activity: Pharmaceutical company produces drug tablets from imported chemicals

Imported Chemicals: 6.5% duty rate

Drug Tablets: Duty-free

Set-up: 6 months with multiple agency application approvals.

Benefits: Inverted Tariff Relief (pay duty on either the imported chemicals or finished product, in this case, drug tablets)

Simplified Food and Drug Administration (FDA) Weekly Entry Procedures

SAVINGS: $75 million per year

Streamline Global Distribution & Cut Costs